Have you ever wondered why very few people seem to be financially secure while most people seem to be stressed about money?

The secret lies in the fact that they manage their personal finances very well. Personal finance does not only mean saving money; it is a way to maintain financial stability and achieve your life goals. So in this article, we will tell you what is personal finance ?and why it’s very important so that you can manage finance in your life. So that you can stay away from money problems in life.

What is Personal Finance?

Personal finance basically covers the entire journey from saving your money to investing it. It includes everything like banking, savings, retirement planning, etc.

Why is this so important? Without proper financial management planning, you may end up with wasteful spending, debt, or even struggling with retirement.

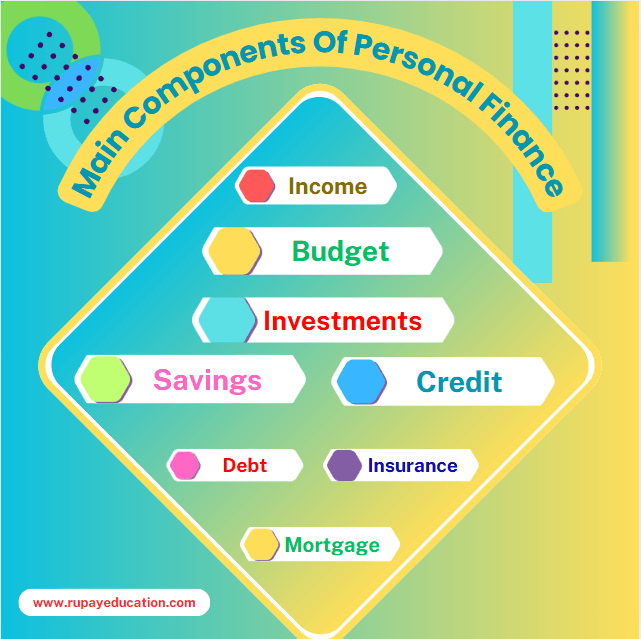

Key Core Components of Personal Finance

Budgeting

Creating a budget is a good basis for personal finance. It includes your income and expenses to ensure you are living within your means. A solid budget helps prevent overspending and ensures you properly allocate money to your priorities.

Benefits of Budgeting

Budgeting helps you get clear on where your money really goes, helps you identify wasteful spending, and helps you relocate money toward savings or investments. It also acts as a constant financial compass to help you stay on track with your goals.

Savings and Emergency Funds

Having savings provides a crucial backup during unforeseen circumstances, such as health crises, losing your job, or needing immediate repairs.

Short-Term vs Long-Term Savings

Quick savings help with things you need right now, like taking a trip or fixing something small. On the other hand, long-term savings are meant for bigger dreams, like buying a house or planning for retirement. It’s also really important to set aside money for emergencies—aim for enough to cover 3 to 6 months of your expenses.

Managing Debt

When used correctly, debt can help you grow financially. But if it’s not handled properly, it can become a heavy weight on your finances

Types of Debt and Strategies to Pay Them Off

There are several typical kinds of debt people often have, like loans for education, credit card balances, and home mortgages. To pay off these debts effectively, you can use approaches like the snowball method, where you focus on clearing smaller debts first, or the avalanche method, which prioritizes paying off debts with the highest interest rates. Both strategies can help you eliminate your debt more easily.

Investing

Putting your money into investments helps it increase in value as time goes by, which is an important part of managing your finances. There are many ways to invest, including stocks, mutual funds, and real estate

Diversification and Its Role in Wealth Creation

Diversifying your investments means putting your money into different types of assets, which helps reduce risk and increase potential profits. This approach is essential for growing your wealth over time.

Importance of Personal Finance

Achieving Financial Independence

Being financially independent means you have enough money to pay for your everyday needs without depending on a job for income. Managing your money wisely can help you reach this goal faster.

Preparing for Life Events

Whether purchasing a house, beginning a family, or preparing for retirement, planning your finances helps ensure you’re ready for important life events.

Minimizing Financial Stress

Financial issues can cause a lot of stress. When you handle your money wisely, it helps lessen worries about finances, which can make your life feel calmer and healthier.

Tools and Strategies for Effective Personal Finance Management

Tracking Your Spending

The first step to managing your money well is knowing where it goes.

Apps and Tools for Expense Tracking

Applications such as Mint, YNAB (You Need A Budget), and PocketGuard assist you in keeping an eye on your spending habits, creating budgets, and following your financial progress.

Creating a Financial Plan

A financial plan is a guide that helps you set both your immediate and future money goals, as well as the actions required to reach them.

Building Good Financial Habits

Sticking to a routine is crucial. Developing habits like saving money consistently, steering clear of impulse buys, and checking your financial progress can help you achieve lasting success.

Common Mistakes in Personal Finance

Living Beyond Your Means

It’s easy to fall into the trap of spending more money than you make. While credit cards and loans can help cover the difference, relying on them too much can cause serious money problems down the road.

Neglecting Retirement Planning

A lot of individuals focus on their immediate spending instead of setting aside money for retirement. By beginning to save early, you can benefit from compound interest, which helps your savings increase over time

Mismanaging Credit

Credit can be both helpful and harmful. When you use it carefully, it can improve your credit score. However, if you handle it poorly, it may result in expensive debt and a low credit rating.

Role of Financial Education in Life

Why Financial Literacy is Key

Understanding finances helps people make smart choices about their money. This important skill lasts a lifetime and affects everything from how we manage our daily expenses to planning for retirement.

Resources to Improve Financial Knowledge

Reading books, taking online classes, and attending workshops about personal finance are great ways to improve your understanding of money matters. Two well-known books that many peoples find helpful are Rich Dad, Poor Dad by Robert Kiyosaki, and The Total Money Makeover by Dave Ramsey.

Future of Personal Finance

Technology’s Role in Personal Finance

Technology is transforming how we manage our money by introducing smart financial advisors powered by AI, automated investment tools, and sophisticated budgeting applications.

Develop Attitudes Toward Money Management

Younger people are developing the way they think about money. They value experiences more than things and are making investment choices that support sustainability.

Conclusion

Having a good grip on your personal finances is the key to living a secure and happy life. By learning the basics, understanding and avoiding common mistakes, and using helpful resources, anyone can manage their money wisely and achieve a better financial future.

Affiliate Disclosure Note: Some of the Outbound links in this post are Amazon affiliate links. We earn a Small Commission from qualifying purchases without any extra cost to you

What are the main key elements of managing your money?

Managing your money involves five key areas: creating a budget, saving for the future, handling debt wisely, making smart investments, and planning your finances.

What are some steps I can take right now to get better at managing my money?

Begin by making a budget, keeping an eye on your spending, and establishing specific financial objectives.

What makes budgeting important for managing your personal finances?

Creating a budget helps you spend within your limits, use your money smartly, and reach your financial objectives.

What are the best tools to manage personal finance?

Applications such as Mint, YNAB, and PocketGuard are great tools for keeping an eye on your spending and managing your budget.

How does personal finance differ from business finance?

Personal finance is all about how people handle their own money, whereas business finance is concerned with how companies manage their financial resources.